In focus: Building your confidence, and your future

The results from The Prince’s Trust NatWest Youth Index 2023 show that the happiness and confidence of 16-25-year-olds has flatlined at an all-time low in the fourteen-year history of the survey. It’s not surprising, with the rising cost of living and the effects of the pandemic still in full force – so how you can work towards a more positive future? We’re here to help

For the last 14 years, The Prince’s Trust has carried out a survey that looks at the happiness and confidence of 16-25-year-olds in various aspects of their life across the UK. This year’s results are worrying: young people’s overall happiness and confidence with money is now lower than when polling began in 2008 during the Global Financial Crisis, with 35% agreeing that thinking about money depresses or stresses them. The stats are similarly bleak when it comes to mental health and jobs.

But don’t despair: help is at hand. Whether you want money management support through tough times, guidance when looking for work, advice on achieving those big life goals, or tips for boosting positive thinking – we’re here to offer some practical, actionable support.

Money and mental health

The survey said: One in four young people (26%) feel like they are going to fail in life. 56% of young people say they always or often feel anxious.

So, what can be done? “When it comes to finances, one of the best things we can do as a society is to talk about them more openly,” says Tamara Gillan, founder and CEO of the WealthiHer Network. “By doing this, we’ll hopefully make money a less taboo subject in the future.”

But it also has another effect: “I’m a big believer that if you have real worries or concerns about finances – or anything for that matter – one of the most powerful steps that you can take is to talk to someone about them, because bottling things up can be seriously bad for our mental health.” There are no rules on who you turn to – whether it’s a friend, family member, teacher, colleague or even someone at your bank, don’t be afraid to share your concerns with someone you trust.

Managing your own expectations and the pressure that you’re putting on yourself is also very important. Remember that no-one has everything figured out in their teens, or even their 20s or 30s for that matter!

To learn more about the link between money and mental health, watch this MoneySense video, or read this article which offers tips on handling financial worries.

Finally, if you get to a point where you feel you are really struggling from a mental health point of view, make sure you ask for professional help. It’s never too early and no problem is too small. Martin Lewis – the Money Saving Expert – recommends Rethink, Mind and The Mental Health Foundation.

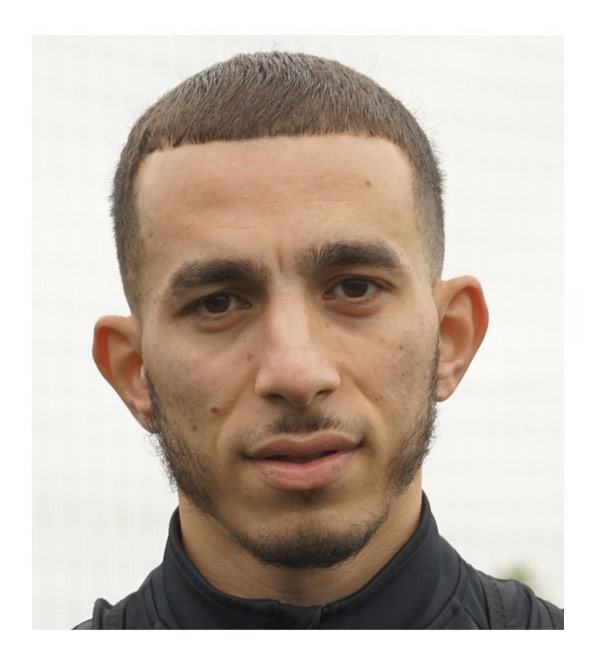

We asked some influencers for their advice when it comes to building your confidence and managing anxieties about the future. First up, Mahrez AKA @thegaffermaz:

“Don’t sit there and worry in silence. If something is stressing you out, speak to a professional who could kick start your financial journey and help relieve any unnecessary stress due to lack of knowledge.”

The cost of living crisis

The survey said: 57% of young people report the rising cost of living as the biggest worry for their future, and 46% say that economic uncertainty makes them feel hopeless about the future. 24% of young people also report feeling ashamed about not being able to pay bills.

First things first: don’t panic, and don’t give up. Struggling to make ends meet in the current climate is nothing to be ashamed of, and it’s totally normal to find money management challenging – but it’s important not to ignore the problem if your finances are getting on top of you. Despite times being tricky, you need to be in the driver’s seat here – this is your life and it’s there for the taking.

Begin by talking about it – whether that’s to a trusted friend, a family member, or a professional at organisations like Barnardo’s and The Prince’s Trust, who offer employment support such as free courses, apprenticeships and tuition funds, and StepChange, who provide free advice and help setting up solutions to deal with debt. Being open about money worries can feel uncomfortable at first, but there are lots of people out there who will be able to empathise with what you are going through, and genuinely want to help!

Next, do some research into your contracts and bills. Your bank, and lots of utility suppliers will be all too aware of the current economic climate, and may well have ways to support you with a manageable payment plan if you’re living independently. It’s also worth checking that you’re up to date on any deals they have on offer, and shopping around for anything new. Comparison sites can help you shop around for the best deals on new contracts, and there are also loads of helpful free tools out there which can help you plan and stay on top of your budget – like Royal Bank of Scotland's new budget calculator tool.

It can also help to begin to set realistic goals for the future and tick them off as you achieve them – the dopamine (aka the happy hormone) kick that you’ll get when this happens will make you want to cross more actions off your list. Perhaps you could set yourself a target of brushing up on finance in general – you could learn financial lingo, or get to grips with credit scores or investing.

It’s also worth remembering that, despite sometimes seeming a little intimidating, banks really do want to help you. Royal Bank of Scotland, for example, offers completely free personal reviews in the shape of Financial Health Checks. During these sessions, you’ll be given helpful hints, tips, and ideas to help you make better decisions about your finances, both now and in the future.

“Financial health checks are a great way to assess what someone is doing well and what they need to work on. They’re open to anyone and are a helpful reminder to review your needs and goals,” says Milly Batchelor from Royal Bank of Scotland's Youth Banking team. “I get one done every other year, even though I work for a bank, and I’m always grateful for the help. They allow you to access professional support and tips to help you get or stay on-track.”

Financial security and your life goals

The survey said: Almost two thirds (64%) of young people say financial security is their biggest goal in life, followed by good mental health (43%). More young women than young men have lowered their aspirations due to the rising cost of living, with 52% saying they have lowered their expectations for their future goals, compared to 43% of young men. Despite this, 70% of young people remain determined to achieve their goals in life.

Though times are undeniably tough at the moment, that doesn’t necessarily mean you need to lower your aspirations and expectations for the future – just that you might need a helping hand and some smart thinking to get you there. Having a positive mindset may feel tough right now, but there are lots of things you can do to help – check out our article to find out how to think positive.

It’s clear that feeling financially secure has a huge impact on overall wellbeing, too, so work out what exactly you need to skill-up on to feel more in control. Learning from peers can also be a good starting point when it comes to working towards your financial goals. If you have a friend, colleague, or family member who is smart when it comes to looking after their money, ask if they have tips, tools or strategies that they find useful. Alternatively, you can seek this kind of information out online, like in our intro to investing article.

Budgeting is an art that has to be learnt and practised, and then practised some more, but there’s no shortage of guides and resources out there. Look into different savings strategies such as the 50/30/20 rule (where you spend 50% of income on needs, 30% on wants, and 20% on savings/repaying debts) or check out this video on how to budget like a boss, and this article on five ways to save, make and manage your money. Most banks offer clever apps that can help you look at your finances as a whole, help you make smarter spending decisions, and even cancel unnecessary subscriptions.

“Successful saving is about having a rule of thumb for spending, and sticking to it,” says Angela Connor from Royal Bank of Scotland's Youth Banking team. “That could be having a plan of how much you spend versus how much you save and sticking to it – for example, for every £10 you earn, you could save £2 – or setting yourself a rule of how much you need to have saved up before you buy yourself a treat. It's always good to try and have a buffer of savings left over in case you need it for an emergency.”

We asked influencers Sammy and Courtney from @grayskitz ahow they’d recommend building your confidence and managing anxiety about the future:

“Try to get into a money mindset as early as possible. It’s important to have a healthy balance between fun and goals, so save where you can and make a plan – where do you want to be in five years? It can be hard and scary at times, but if you set yourself mini targets and work towards those, you’ll make progress without getting stressed out by the bigger picture.”

The world of work

The survey said: 70% of young people state that having a job gives - or would give - them the financial stability they crave, and 59% say being employed is good for their mental health. 45% worry that they will never earn enough to support a family – rising to 53% of those from less affluent backgrounds.

It goes without saying that the pandemic and the rising cost of living have been tough on young people in education and those trying to make the leap into the workplace. But don’t forget that potential employers will understand what everyone is going through and be sympathetic to any gaps on your CV that may be a result of this.

That said, only you can control the direction that your life takes from here, and there are lots of opportunities to up-skill and get some training if you know where to look. Take time to think about the skills that you would most benefit from and investigate courses that would support these. Don’t be afraid to ask for help and advice from teachers, relatives, or older siblings.

Youth Employment UK’s careers hub and young professional training sites are both great places to start when it comes to choosing and developing a career, as is CareerSense – an education programme for 13–24-year-olds that includes free tools and resources to help you understand your own skills, navigate the job market and build your confidence as you enter the world of work.

It’s also worth thinking about how the world of work is changing and therefore what skills you might need to develop. Create an account to try the Find Your Potential tool from CareerSense, which can help you understand your skills and strengths and show you some examples of the types of roles that might suit you. Barnardo’s and the Prince’s Trust also offer employment support, from free courses to apprenticeships and tuition funds.

Volunteering is another excellent way to expand your skillset while giving back to your community, and taking on a side hustle could help you earn some extra cash while perfecting and showing off your entrepreneurial spirit. It can help to take the bigger goal of “financial stability” and break it down into smaller, achievable steps.

Influencer Jessie, aka @mimidarlingbeauty, has this advice when it comes to planning for the future:

“Remember you’re not alone. There is a lot of help and advice out there and it’s more accessible than ever before. Being able to access information online means that people don't even need to leave the house to find help, and it’s available to everyone.”

All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 2025 adults. Fieldwork was undertaken between 22nd November - 7th December 2022. The survey was carried out online. The figures have been weighted and are representative of all GB adults (aged 18-25).

Image credits: Adobe Stock